Rate rise: preliminary discussion on City operating budget looks up

The City is predicting more than a three per cent baseline increase in municipal taxes in the coming year in the face of increasing costs over 11 per cent.

In a Dec. 7 regular meeting of Nelson City council heard from City staff that there could be a 3.08 per cent baseline increase to municipal taxation for the operating budget, according to the proposed Nelson financial plan for 2024-2028 document.

The increase — based on an average home assessment of $674,000 — would be $59.62 per year, marking the starting point for the taxation conversation that will be playing out over the next few months.

However, the increase does come with much pressure on the other side of the taxation ledger, with the City facing a total escalation in costs for operations for the coming year at 11.05 per cent, with additional revenue dropping the need for taxation by 7.97 per cent.

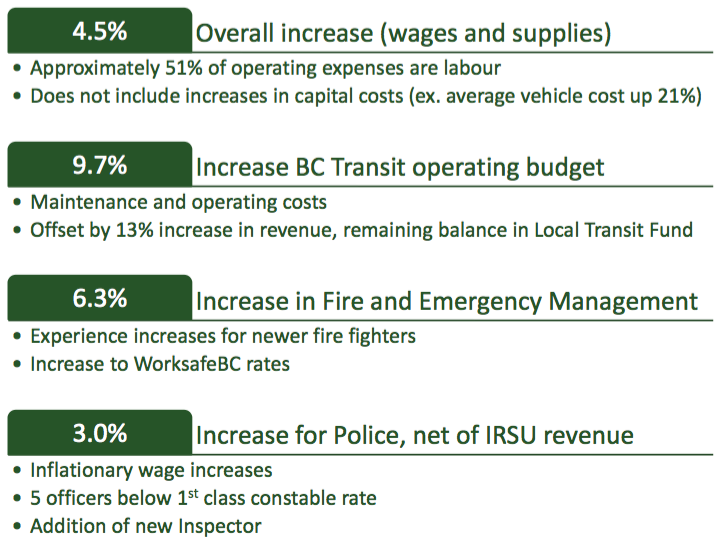

City chief financial officer Chris Jury said in his presentation to City council that there is a 4.5 per cent overall increase to City staff wages and supplies. Although approximately 51 per cent of operating expenses are labour, it does not include increases in capital costs.

Jury explained there will also be a 9.7 per cent increase to the BC Transit operating budget — maintenance and operating costs — offset by a 13 per cent increase in revenue. Fire and Emergency management will also see a cost increase — predicted to be 6.3 per cent — to cover “experience increases” for newer fire fighters and an increase to WorksafeBC rates.

The Nelson Police Department is also asking for an increase — proposed at three per cent — to cover inflationary wage increases and to help cover the addition of one new NPD inspector.

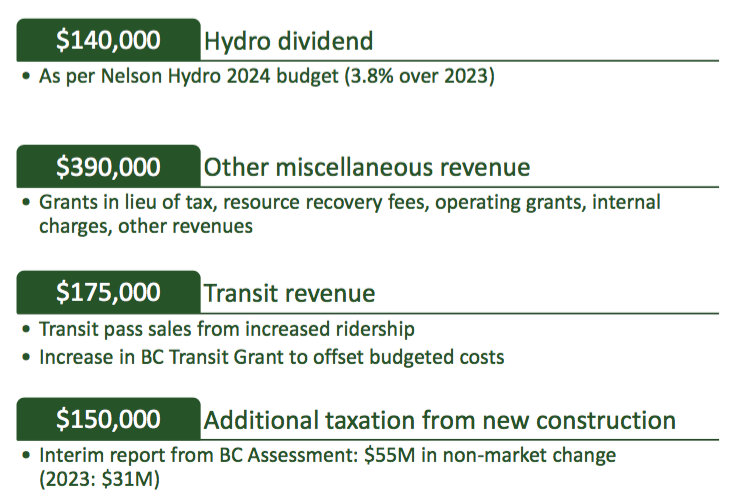

Nelson Hydro will be dropping a $140,000 dividend into the City coffers — as per the Nelson Hydro budget which increases 3.8 per cent — and there will be $390,000 in other miscellaneous revenue, such as grants-in-lieu of taxes, resource recovery fees and operating grants to prop up the budget bottom line.

The City is also predicting a $175,000 source of revenue from transit next year — from the sale of passes and increased ridership — with $150,000 in additional taxation from new construction.

Last May 2023 City council approved a 5.8 per cent increase in municipal property taxes, despite a rising inflation rate beyond that figure, while still being able to continue to provide the same services to Nelsonites.

“(T)he growth of inflation has slowed but we are still seeing increases and, of course, that is something we are catching up a bit from … and trying to contain these costs in our … budget,” Jury said when speaking previously on the budget. “If you look at a lot of the services the city provides … we have really endeavoured to keep that overall tax increase to the tune of inflation, or below levels.”

In 2019 the City instituted a 1.9 per cent tax increase (inflation of 1.9) followed by a 2020 1.8 per cent increase (.7 inflation), with 2021 a 1.6 per cent increase from the city (inflation was 3.4 per cent) and a 2022 increase from the city of 3.9 per cent (6.8 per cent inflation). In 2023 the city’s 4.2 per cent increase is behind the rate of inflation of 5.2 per cent.

Taking the average home assessment value of $674,000 in 2023, Nelsonites saw an average tax of $1,936, an increase of $106 for the year, or $8.85 more per month. In 2022 the average municipal tax was $1,830.

Section 165 of the Community Charter requires that a financial plan be adopted annually, by bylaw, before the Annual Tax Rate Bylaw is adopted. All proposed expenditures, funding sources and transfers, to or, between funds must be included in the plan.