From The Leg: Concerns about spending initiatives, ability to fund

April MLA Report

Flooding:

We are once again at the mercy of Mother Nature. An unusually high snow pack and heavy rains have again put many of you in harm’s way. I have met with all the agencies involved who are working around the clock to try and keep your homes and property safe. It is an uphill battle. The water table remained at higher than normal levels after last year’s flooding, compounding this year’s problems.

I am confident in the work that the RDOS, Highways and EMBC are doing on our behalf and receive updates several times each day. I will continue to work with these agencies and others on your behalf and pray with you every day for sunshine.

In the Legislature, we have been and continue to be, deeply involved in the budget process and the implications of new taxes on British Columbians. This is where opposition can question each Minister on their budgets line by line, but also ask questions on the reasons behind spending in certain areas.

I have concerns about many of the spending initiatives and the ability to fund them without adding multiple taxes to do so. Obviously the NDP and the Liberal governments have very different philosophies on the best way to provide services while growing the economy and helping those at the low end of the earning envelope. I’ll just mention a couple of fundamental differences.

The Carbon Tax:

Our government was a leader in environmental policy and recognized for that globally. The Carbon Tax was introduced by the Liberals, but was administered as a revenue neutral tax. For every percent of carbon tax, sales taxes and personal income taxes were lowered to offset the impact to the people of BC. The NDP government is increasing the carbon tax with no offsets. Regardless of where you are on the income scale you will be paying more for all forms of fuel. Farmers will pay more, as will the truckers who transport the produce to market and the food prices will rise to compensate. It will trickle down to all consumers. This is not making life in BC more affordable.

Speculation Tax:

The upcoming tax on Assets and Capital (Speculation Tax) will affect every person who has a second home or vacation home in Vancouver, Kelowna/West Kelowna or on Vancouver Island, whether you live in BC or not. People who have been coming to BC for generations to a cabin on a lake etc., will have their property taxes jump. One property owner from Alberta who has a vacation property on Vancouver Island will see his property tax go from $3000 to $10,000.

Is the purpose of this tax to punish all who have a second home and force them to sell? What about people who bought property as a retirement asset instead of buying into the stock market.

They will see their asset drop by 10% each year with this punishing tax. And what about all those tourist dollars those vacationers spend while in BC? Many who come for the winter months also volunteer in our communities, and they contribute to our economy.

The clear message BC is sending to the rest of the world is that all non-residents are not welcome here because they are disrupting the real estate market. The real culprits are more likely the low interest rates, inadequate housing supply, and the strong economic growth BC experienced under the former government.

Minimum Wage:

There is an impact to the economy of BC with the increase in minimum wage despite the positive spin put on it by the NDP government. Raising the minimum wage has been sold to British Columbians as a solution to poverty. A recent article in the Province by Lamman and MacIntyre shows that statistically, minimum wage does a poor job of targeting the people we really want to help. According to Stats Canada, the vast majority of minimum wage earners don’t live in poverty. In fact 89% aren’t part of a low income family. The overwhelming majority of minimum wage earners aren’t the primary or sole wage earner in their household.

They are mostly teens or young adults working their first unskilled job or working part time while in school. In BC 54% of minimum wage earners are under twenty-five with the vast majority living at home or with relatives. This is not a tragedy- l started into the workforce that way as did my children and now my grandchildren.

The image of a single parent struggling to get by on minimum wage is rare – only 2.1 % of minimum wage earners are single parents. Canadian research finds that past hikes in minimum wage have failed to reduce poverty. 70% of the income gains go to non-poor households. One study according to the article found that raising the minimum wage can actually increase poverty.

Job losses associated with a higher minimum wage are disproportionally felt by the poor. Raising the minimum wage also makes it harder for less skilled workers to find jobs and employers will cut back on the number of people they employ, as well as benefits and training. And in many cases the higher wage costs are passed along to the consumer through higher costs of goods and services.

I will continue to do my job in Victoria representing the interests of the people of the Boundary- Similkameen and be your voice on any issues that present themselves.

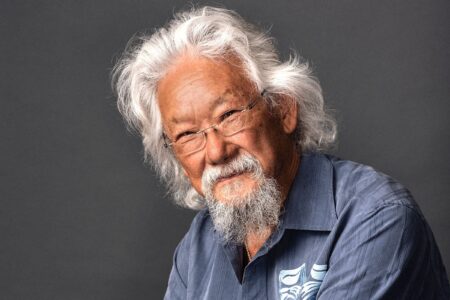

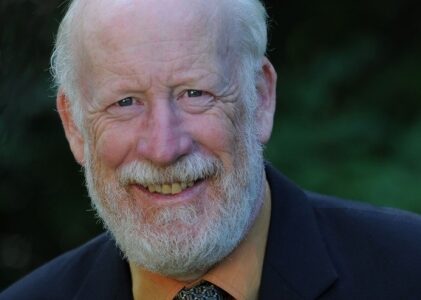

Linda Larson, MLA, Boundary – Similkameen