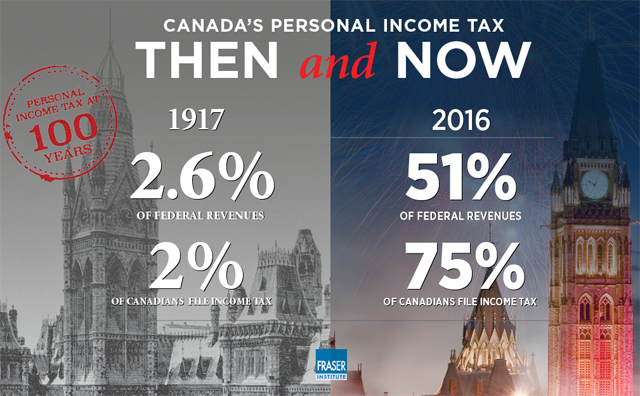

Canada’s personal income tax turns 100

After 100 years of taxing Canadians, the personal income tax, which began as a small wartime revenue generator, has morphed into a costly, complex behemoth that’s difficult to administer and makes Canada very uncompetitive, finds a new collection of essays by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“The fears policymakers had in 1917 when the personal income tax was introduced—that governments would become dependent on it and that it would hurt our competitiveness—have all come true 100 years later,” said William Watson, Associate Professor and Acting Chair of the Department of Economics at McGill University, Fraser Institute senior fellow and co-editor of The History and Development of Canada’s Personal Income Tax: Zero to 50 in 100 Years.

“Just filing their taxes costs the average Canadian family $500 in time and money, even before they get to what they owe,” Watson added.

The book, a collection of essays from some of Canada’s leading tax experts, documents changes to the personal income tax over the last century.

Crucially, Canada’s high personal income tax rates on its best and brightest workers have made the country uncompetitive compared to other developed countries and most American states.

For example, a hike to the top federal rate to 33 per cent in 2016 brought Ontario’s combined federal-provincial tax rate to 53.5 per cent, making it the third highest in the G7 behind only France (54.5 per cent) and Japan (55.9 per cent).

What’s more, when compared to U.S. states, Canadian provinces have seven of the eight highest top combined rates, with Nova Scotia, Ontario, Quebec, New Brunswick, P.E.I. and Manitoba all over 50 per cent.

Even B.C., which has Canada’s lowest combined top rate (47.7 per cent), is still higher than 42 U.S. states.

Moreover, Canada’s top personal income tax rates kick in at relatively low levels of income—between $200,000 and $300,000—compared to about CAD$550,000 for most U.S. states. Others have even higher thresholds. In New York, for example, the top combined federal and state tax rate of 48.42 per cent only applies to incomes of $1.4 million or higher.

“Canada is already uncompetitive with the U.S. on personal income taxes, and with the Trump administration vowing to reduce taxes further, that gulf will likely grow,” Watson said.

“When it comes to taxing personal income in Canada, maybe a century is long enough.”