COMMENT: BC's budgetary sleight of hand

The funny thing about provincial budgets is that sometimes they tell you a lot more about a government's attitude than what the politicians might have intended when they first wrote the document.

Case in point: most governments like to pat themselves on the back at budget time by highlighting the impact of their fiscal policies on family budgets.

In last year's provincial budget, the Saskatchewan government put forward three such scenarios: one for a single person earning $25,000, another for a family earning $50,000 and the third for a family earning $75,000. They called it “Keeping the Saskatchewan Advantage.”

Go back to 2003 and the B.C. government did the same, putting forward three scenarios as well: one for a single individual earning $25,000, one for a family of four earning $60,000 and one for a retired couple earning $30,000.

Fast forward ten years to last week and the B.C. government highlighted four family models. Boy did they ever change.

The first is for a two-income family of four earning $90,000, the second is for a two-income family of four making $60,000, the third is for a single individual pulling in $80,000, and the fourth is that obligatory retired couple still struggling to get by on $30,000.

It would seem – at least for the B.C. government – that nearly everyone in the province is a whole lot wealthier than they were in 2003.

But the scenarios are also telling for what the two governments included and what they left out.

On top of various provincial taxes, the Saskatchewan government threw in hydro costs, auto insurance, telephone and housing. The B.C. government kept it to the bare essentials: income taxes, net property taxes, sales and fuel taxes, net carbon tax and MSP premiums.

Those pesky health care premiums stand out though. In Saskatchewan's modelling, only two provinces have premiums: B.C. and Ontario. And while the Ontario government prefers to call it a premium for political reasons, it's really a tax on personal income.

Introduced in 2004, following Dalton McGuinty's 2003 election pledge not to raise or implement any new taxes, the word “premium” probably seemed like a linguistic godsend at the time.

So what's the difference between Ontario's “premium” and the one imposed in B.C.?

In B.C., someone earning $30,000 a year pays the full-freight of $69.25 each month. In Ontario, you would need to earn more than $200,000 a year before you paid the equivalent amount under that province's health care tax.

Ontario brings in about $3 billion from its “premium” and that's in a province with 13.5 million people. In B.C., MSP premiums are forecast to bring in $2.27 billion this year, in a province with less than one third of the population of Ontario.

Finance minister Mike de Jong had a few other fiscal tricks up his sleeve as well.

In 2002, the total contributions of all “self-supported Crown corporations” to the provincial treasury was $1.44 billion. This year, those corporations are being told to cough up $2.89 billion.

But no matter what the government chooses to call them, these “contributions” are a form of taxation. As the saying goes: if it walks like a duck, swims like a duck, and quacks like a duck, then it's probably a duck.

The government plans to pilfer B.C. Hydro for $582 million this year, up $250 million from 2002. This so-called “dividend” has already been passed on to British Columbians through a 28 per cent rate hike announced last year.

The B.C. Lottery Corporation will sign a cheque to the province for $1.2 billion, up a whopping $734 million over 2002. An ironic sum coming from a political party that promised in 2001 that "a B.C. Liberal government will stop the expansion of gambling that has increased gambling addiction and put new strains on families."

Perhaps the order of the day in last week's budget should have been a little less fiscal sleight of hand and a little more tax fairness.

Because when a government starts believing that the impact of its fiscal policies on a single individual earning $80,000 is appropriate for inclusion in the budget, it's a pretty safe bet that they've lost touch with what most people go through at the end of the month just to make ends meet.

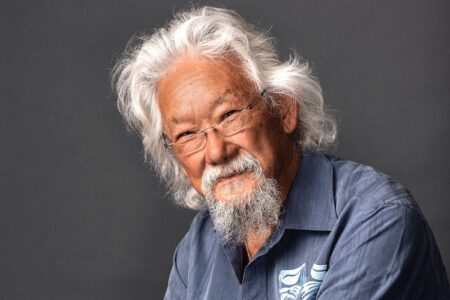

Dermod Travis is the executive director of IntegrityBC. www.integritybc.ca