DOBBIN: A response to the banker's association

When is a bank bail-out not a bailout? When the Canadian bankers’ Association President, Nancy Hughes Anthony says so. In her letter to the Vancouver Sun (which published my blog on the issue) Hughes Anthony points out that not a single bank went bankrupt and therefore did not require a bail out.

But call it what you will – the Canadian government borrowed and spent billions to backstop the banks lending during the recession and continues to do so. That borrowing is a cost to the taxpayer and many of the mortgages they bought up (starting with $75 billion in the fall of 2008 and then adding another $50 billion a few months later) could still go into default. If they do the taxpayer is still on the hook – not through the government but through the CMHC, a government backstopped crown corporation that had to be rescued by the taxpayer before.

Over 375,000 Canadian mortgage holders are already “challenged” by their monthly payments. When interest rates hit 5.25 per cent, an additional 500,000 will be.

The big banks themselves know there is a problem. How do we know this? Because they approached the government and asked that borrowing be made more difficult. According to the Globe and Mail:

“The heads of the country’s six largest banks have privately told policy makers that they fear the wide-ranging economic fallout of a U.S. style binge-and-collapse in housing. To head off any chance of that happening, they are willing to accept tighter rules on mortgages that would slow the real estate market…

The country’s top commercial bankers … said then that they wanted the government to look at far-reaching options, such as raising the minimum down payment to as much as 10 per cent [now 5 percent] and shortening the maximum amortization period to 30 years.[now 35 years].”

Hughes Anthony declares that “…the Office of the Superintendent of Financial Institutions closely monitors their lending portfolios to ensure that they are lending prudently and managing risk properly.” Obviously not, or the banks wouldn’t have begged the government to intervene – essentially asking that it save them from their own reckless behaviour.

Are the banks “…lending prudently and managing risk properly.”? Hardly. At a time when housing prices in the US were dropping by over 20 per cent in the global recession, Canadian housing prices were skyrocketing because of Canadian banks’ reckless lending policies. As of December, 2009, the average resale price of a home in Canada was $337,410. That was 19 per cent higher than a year earlier. This cannot possibly be called “lending prudently” and the banks know it – or they wouldn’t have asked the government to tighten lending rules.

Not only are Canadian banks’ practices putting ordinary Canadian home-owners and tax-payers at great risk their reckless behaviour is even threatening their own viability. According to Moody’s Weekly Credit Outlook, of January 25, 2010:

“We are concerned about the unintended, long-term consequences of a prolonged period of low interest rates on the credit profiles of Canada’s banks. More specifically, our concern centers on the possibility of an unsustainable expansion of consumer credit, fueled by the housing sector.”

Moody’s goes on to say:

“We have the uneasy sense that we have seen this movie before: the one where inexpensive and available household credit leads to rising house prices which, in turn, leads to intensified demand for household credit. As witnessed in the United States, this movie does not end well.”

How might the Canadian movie end? Quite possibly with another recession. Moody’s points out that when the bubble collapses there will be a massive de-leveraging. Much of the Canadians’ net worth is tied up in their houses. When the inevitable tighter rules and higher interest rates kick in home prices will fall and consumers will rein in their spending.

As Moody’s argues, this isn’t just bad for the Canadian economy, it is bad for the banks themselves:

“The domestic franchises of Canada’s banks would suffer in this scenario, mainly due to a deterioration in the broader Canadian economy that would accompany household deleveraging.”

Ms Hughes Anthony is very casual about the government’s agreement to take billions of dollars off the banks books. She stated: “When the global credit markets seized up, the government of Canada bought insured mortgages from the banks to ensure that credit continued to flow to consumers and businesses.”

No doubt. The Harper government desperately wanted Canada to avoid a recession and goosing the economy through fostering massive housing sales did the trick. It was this highly political decision that led to the situation of Canadian families being burdened by unsustainable credit.

In its 2008 Review of Canada’s private banks the Bank of Canada stated: “The more traditional business model pursued by Canadian banks, where a greater proportion of loans remain on the balance sheet of the originator,has encouraged higher quality underwriting practices.”[italics added] So what’s the implication here? It would seem that when they were able to get those mortgages off their balance sheets through the $125 billion government purchase program (plus another $12 billion purchase of other loans, like car loans) the opposite was the case: the quality of their underwriting practices was lowered.

That is precisely what is demonstrated by the absurd increases in housing prices in Canada.

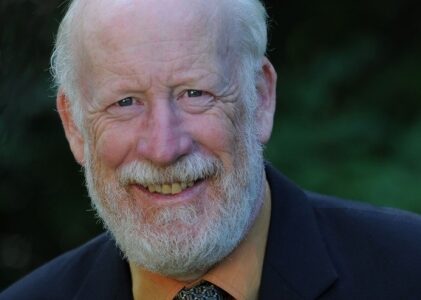

Murray Dobbin is an author, broadcaster and journalist. He is the author of five books and his work appears regularly in the Tyee.