OP/ED: Just say no to hated sales tax

How often do we complain that our governments are passing legislation or bylaws that affect us but we have no control over? How many times a year do we grumble about the high cost of this or that? Well a small group of citizens have pushed hard enough to allow us to have the chance to say no to new taxes. In the next 90 days official Elections B.C. canvassers will be coming through our towns to ask our opinion about the harmonized sales tax (HST or newly coined hated sales tax) and I for one am going to vote!

As a citizen it is frustrating to hear that our health care system or the school district doesn’t have enough money and cutbacks are the only answer. We regularly agree to accept worse service from our government funded agencies and although we grumble to our neighbours, we rarely take action. Parents around our region are starting to stand together to protect the school services, but who will protect our interests in everything from ambulance services to social services?

The HST is not the way to solve all these funding problems, even if Premier Gordon Campbell will give the surplus to health care. We’ve seen that even with funding increases to school budgets, every district is faced with serious shortfalls so the HST won’t solve rising health care costs. Fighting the HST won’t fix any of the problems we’re facing in service costs, but standing up to say we’ve had enough of rising costs in our lives will send a strong message to the province that the citizens have had enough!

The HST is touted to be of benefit to our small businesses and will encourage employment. I personally, as a small business owner, fail to see the way it works. Yes, I won’t have to fill in two different tax forms, but right now I don’t fill in any! Once the tax is in place I will have to charge the full tax to customers. Yes, I get my purchase tax costs refunded, but I would have under the old system as well. No extra bonuses there!

As a citizen, my costs to purchase will increase since many of the currently provincial tax exempt items will now be taxable. Along with these increases, we can now look forward to a nine per cent increase from B.C. Hydro, six per cent increase from Teresen Gas, seven per cent increase on BC Ferries, provincial park camping fees are up $5 per person, our medical services plan is up, and on July 1 the wonderful carbon tax jumps again by 4.5 cents. All this from a government that refuses to increase the minimum wage, now the lowest in Canada. And we didn’t have a voice on any of this.

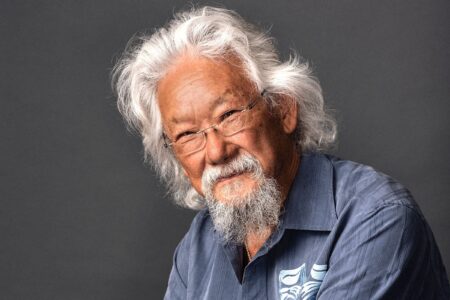

All of the increases to the coffers of the provincial government are coming out of our pockets and yet we are still losing services. No, our personal income tax rate has not increased, but as we look around there are increases everywhere. As much as I don’t like Bill Vander Zalm, I have to admit his drive to fight the HST on the basic principle that the people have a right to a say on taxation is a train that I can get on.

The Citizen Initiative to repeal the HST requires the signatures of 10 per cent of registered voters in all 85 electoral districts in BC to be successful. Fight HST is targeting 15 per cent or better in each riding to ensure a safe margin of victory. Signature gathering by canvassers will take place mostly on evenings and weekends, with some central location sign-ups planned for each region. You can also go the extra step and sign up as a canvasser.

Right or wrong, the opportunity to have a say on our future is staring us right in the face. We need to stop being apathetic Canadians and stand up for what we want. If you don’t vote, don’t whine later.

Link: