HST petition starting in April

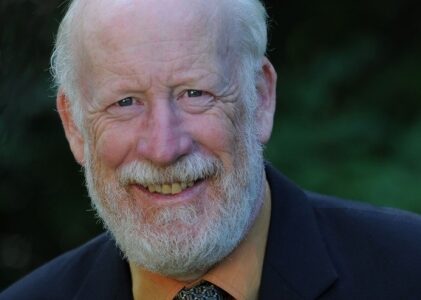

Last fall Paul McCavour toured the Boundary Similkameen riding to set up volunteers to fight the harmonized sales tax (HST) slated to be initiated in B.C. next July. Now that Elections BC has approved in principal the Citizen’s Initiative Petition to fight the HST, it is time to get busy, said Fight HST organizer McCavour.

“People are still upset at the deception and are galvanized to do something about it. The HST issue has not gone away and people are aware of our petition initiative,” McCavour said, adding, “If you’re not on the voters list, you can’t sign the petition. Call Elections BC toll-free at 1-800-661-8683 and get registered to have your say.”

When McCavour spoke to residents throughout the Boundary last year he outlined his plans for the petition drive. This month, he is re-visiting volunteers to finalize plans in the communities of Grand Forks, Greenwood, Keremeos, Okanagan Falls, Oliver and Osoyoos.

Beginning April 6, volunteers will be holding ‘Petition Days’ at central locations in different communities. People interested in signing the petition can stop in at these locations to sign. There will be no door-to-door canvassing. McCavour expects a big turnout.

“There will be ads in each community informing residents when and where to sign the petition,” McCavour added.

The petition could slow the implementation of the HST, and ultimately will give voters a say on the process. As a non-political person, McCavour’s goal is just that – to give the people of B.C. a choice.

“As soon as I was done (with my presentation) in Oliver they said we have volunteers, we’ll give you the hall without cost and we’ll put some money in for ads in the paper. That’s democracy in action,” said McCavour last fall. “People have a choice – they come and sign the petition,and say: I’m defeating the HST; if I choose not to sign the petition, the HST will come in. But at least you’ve got a choice.”

According to McCavour, estimates show that a family of four will pay an average of over $2,100 in new taxes under the HST, even after rebates and exemptions.

The provincial government information about the new tax system advises that there will be cost savings to consumers. The province’s HST website states: “Right now, provincial sales tax (PST) is paid by every business at every step in the creation of a consumer product. You may not realize it, but the PST is charged multiple times during the production of a product before it reaches the store. Every business involved in the creation of a product pays the PST on almost all of the things they buy to carry on their business… and the cost of that embedded PST is passed on to you, the consumer. Under the proposed harmonized sales tax most taxes paid on business inputs are refunded to the business, and those savings can be passed on to consumers.”

But McCavour is skeptical. “It’s supposed to be revenue neutral. But my position is that we want a voice. We don’t accept the lie. Give us a voice, give us a referendum. The government might win, but at least we’ve had our say.”

He encourages people who wish to help in any way to contact him in Osoyoos at 250-495-6765, Robert Riddle in Greenwood at 250-445-6697, or David Janzen in Grand Forks at 250-442-0196.